Employment Law for North Carolina Nonprofits

Employment Law for North Carolina Nonprofits: A Handbook for Managers and Board Members of Nonprofit Organizations describes the major state and federal employment law requirements that apply to private, nonprofit organizations and offers suggestions for adopting personnel practices that reduce exposure to costly litigation and produce a more productive workforce. Copyright ©2008.

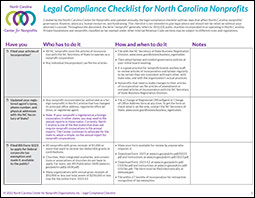

Get the up-to-date Legal Compliance Checklist!

Get the up-to-date Legal Compliance Checklist!