What is the Public Service Loan Forgiveness program?

The Public Service Loan Forgiveness (PSLF) program was established by the federal government in 2007 with the intent of forgiving the remaining balance on federal student loans after borrowers had made 120 months of qualifying payments while working in certain public service jobs, including positions with governments and 501(c)(3) nonprofits.

Unfortunately, the U.S. Department of Labor denied loan forgiveness to the vast majority of PSLF applicants, many of whom had undertaken public service careers partially in reliance on their student loans being forgiven after 10 years.

In 2021, the U.S. Department of Education put in place the PSLF Temporary Waiver to help address the huge number of borrowers whose PSLF applications had been denied despite their 10 years of public service. The temporary waiver is designed to make it possible for millions of public service workers to receive credit for past periods of repayment that would otherwise not qualify for PSLF, thereby reducing or potentially eliminating student loan debt. Under the waiver:

- Past periods of repayment will now count whether or not borrowers made a payment, made that payment on time, for the full amount due, or on a qualifying repayment plan;

- Borrowers with a Federal Family Education (FFEL) Program loan, Perkins Loan, or other federal student loans can benefit by consolidating their loans into a Direct Consolidation Loan and receive credit for periods of repayment pre-consolidation; and

- Borrowers are eligible for forgiveness even if they are not employed by a qualifying employer at the time of application.

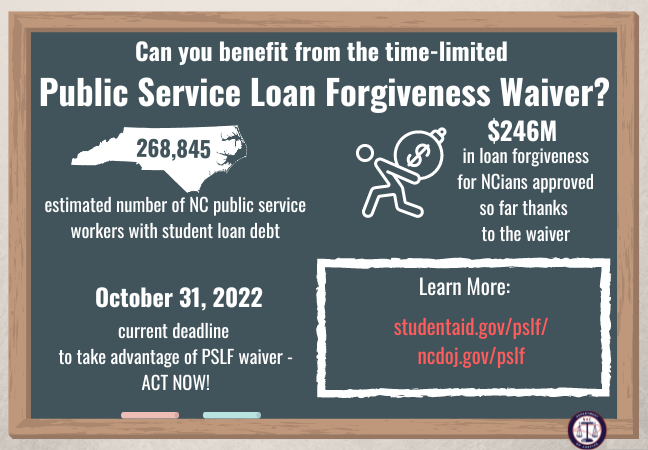

So far, borrowers from North Carolina have been approved for more than $246 million in student loan forgiveness under the waiver.

Some of the provisions available under the temporary PSLF waiver could become permanent and will allow more payments to qualify for PSLF including partial, lump sum, and late payments as well as certain periods of deferment and forbearance. The National Council of Nonprofits has outlined key provisions of the current PSLF law versus the proposed regulations and how it will impact nonprofits and their employees.

The time to apply is now!

The time to apply is now!

To qualify for the PSLF Temporary Waiver, borrowers – including nonprofit employees – need to submit an application by October 31, 2022

Everyone with student loan debt should re-check their eligibility ASAP using the PSLF Help Tool or contact your student loan servicer and let them know that you are interested in PSLF and the waiver. This PSLF How-To FAQs has helpful steps to complete the application and certification process.

Nonprofit employers can also help eligible employees take advantage of the temporary PSLF wavier by:

- Reminding them about the temporary PSLF waiver and the October 31 deadline in upcoming staff meetings or communications with employees.

- Ensuring employees have your nonprofit’s employer identification number (EIN) and contact information for the person on your staff to direct PSLF forms and related questions.

- Sharing the U.S. Department of Education’s free resources about the waiver and The Institute of Student Loan Advisors (TISLA)’s free information about PSLF, how you might qualify, and all things student loans.

Additional Resources

The NC Department of Justice has dedicated resources for Public Student Loan Forgiveness, including a recent webinar recording with Q&A.

Separate from the PSLF, the U.S. Department of Education recently announced the Student Debt Relief Plan that will cancel up to $20,000 of student debt for many Pell grant recipients and up to $10,000 of student debt for many other borrowers. This debt cancellation program may provide additional student loan relief for many nonprofit employees, even if they are also planning to receive loan forgiveness through PSLF. Check out FAQs (including how this debt cancellation works for borrowers in the PSLF program) and a nonprofit perspective on this new student loan relief.

In this article by a current nonprofit leader and former student loan borrower, Rich Leimsider shares his story through the complicated history of the PSLF program to loan forgiveness.