Jaime Campbell, Tier One Services, LLC and Mig Murphy Sistrom, Mig Murphy Sistrom, CPA, PC

We are both CPAs and accounting firm owners, committed to serving the nonprofit sector. We welcome this opportunity to share our observations and advice on how the pandemic has affected the accounting work of nonprofits. Since we are both committed to centering racial equity in our work, we have applied an equity lens to these topics.

Budgeting

“How can we develop a budget when there’s so much we can’t predict?” is a question we both hear often. Expectations are changing faster than your budget can respond to them. Nicky Charles, Chief Operating Officer at Durham Children’s Initiative, remarks, “You just don’t know when [the pandemic] is going to end… We didn’t anticipate the pandemic lasting this long. We pivoted in March [from planned programming] to Basic Needs Support,” and this had a major effect on the budgeting process.

Responding to the challenge of budgeting amidst vast uncertainties involves first acknowledging that you truly cannot know what will happen. Make a list of the major uncertainties. Select up to three reasonable scenarios for each uncertainty. If you are faced with choosing programs to scale back during the pandemic, consider the vital importance of retaining programs that serve communities of color.

- When is programming likely to restart? What will it take to prioritize programs which serve communities of color?

- When do you expect to re-hire furloughed staff? How can you take this opportunity to examine compensation and career advancement with an equity lens?

- What grants can you reasonably expect to receive and for what amounts?

- What revenue-generating activities will you hold, perhaps in a different format than originally planned, and what is the expected revenue?

- What will the effect of COVID be on individual and corporate giving?

Prepare revenue and expense projections for each scenario, grouping best-case, worst-case, and mid-case elements. Create up to three draft budgets to review with your board. With some Excel savvy, you can even present a single budget with toggle buttons for the different scenarios. Together, you will arrive at a useful financial plan.

If there are restricted funds that you may not be able to steward before the restriction expires, proactively reach out to the funders and ask them about revising the grant terms. Some are willing to lift or alter the purpose restrictions; if so, you can keep these grants in your budget instead of forgoing them.

Surviving

Organizations that didn’t have a healthy financial reserve might not survive the pandemic. Revenue sources are shrinking; funders and sponsors are cautious; donors may be less able to be generous, putting a major strain on some nonprofits. We will see an increase in shutdowns and in mergers. If you don’t see a reasonably clear path to survival, immediately begin exploring potential merger partners so the mission can continue to be served as part of a more financially stable organization. This also dramatically increases the chances that some or all staff and management will be able to retain their jobs, at least for the short term.

If your organization is a white-led organization doing anti-racism work or helping communities of color, try to merge into an organization with leaders of color. When white leaders consider merger-related staffing decisions or if they have to initiate layoffs, it’s time for them to consider retaining a diverse staff and following Black leadership as they work together to advance the mission and preserve as many jobs as possible.

Sharing Services

If your organization is a local chapter of a national organization and your back-office support is handled in-house, you are in a prime position to save money without sacrificing quality by adopting a shared services model. In this model, just one accounting team handles the functions for all of the chapters in their group.

This is NOT another toxic case of “let’s pay you the same salary to do three times the work because #NonprofitLife.” So what makes this feasible?

Outsourced accounting firms have been doing this for years. Success in this model requires communication, standardization, and automation.

The sharing chapters should be of similar revenue size, and they need to agree to a common group of programs and common processes for handling deposits, spending, invoicing, and other common accounting tasks. This requires upfront negotiation as well as continued communication to prevent process creep or tech stack creep.

As for automation, you might be surprised to learn about technologies such as ReceiptBank, Hubdoc, Bill.com, Vend, Zoho, and Xero, all of which can automate or streamline the accounting function.

Moving to a shared services model can help you continue to keep the organization alive, thereby preserving jobs and advancing the mission.

Transitioning to a Geographically Distributed Team

Get rid of paper and don’t look back, friends. Stop writing paper checks, stop receiving paper bills, and stop authorizing expense reimbursements by signing with a pen. Stop distributing pledge cards, stop requesting mailed checks, stop sending donation cards with blanks for credit card information. Both money and financial information are more secure when handled electronically, and this opens the way for full support from your accounting department even if they are working remotely.

That’s right - there are processes and tools that are more secure than paper. Just look up “check washing” and “identity theft and credit card fraud” and see how prevalent these are.

Still with us? Take one step further and also consider releasing your hold on when the daily work gets completed.

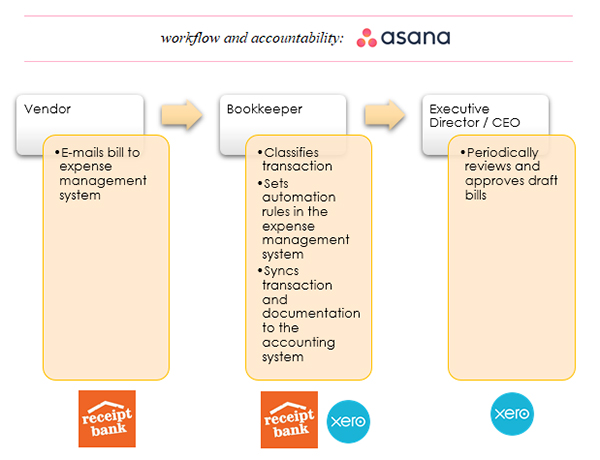

Only certain daily accounting tasks are truly time-sensitive. Now is the time to question the 9-to-5 schedule and to instead adopt systems of communication and accountability to support a more results-based approach. There are workflow systems, even free ones, in which team members can make requests, make promises, and discuss tasks. Jaime’s firm uses Asana; Mig’s firm uses Teamwork; other systems include ClickUp, Trello, Monday, and Basecamp.

Releasing control of the timing and location of work and focusing on promises, end results, and communication positively impacts equitable conditions in your nonprofit. Leadership roles in the nonprofit sector are still largely filled by folks in the majority with one or more of the following characteristics: white, male, able-bodied, heterosexual, cisgender. Institutional obstacles to personal financial health and well-being still exist. Don’t let your organization perpetuate a system of oppression in which the few people with the most organizational power try to control the daily lives of the many people with less organizational power.

How? Here is an example of one secure, paperless accounting workflow, completely independent of location or time of day:

Cancelling and Redesigning Activities

For cancelled or postponed events, consider alternatives to refunding payments received for the event. Invite sponsors to convert their payment to a contribution, or suggest that you retain the sponsorship payment to apply to a future event. Event registrants may also be receptive to contributing their registration fees. Ensure that members of your team who communicate with your constituencies are aware of these possibilities, so that they can refer people to the right team members to help them understand the option to convert payments to contributions.

Make sure your accounting team is informed of any changes in the nature of the event revenue so they can update the accounting records.

As you consider innovative or unfamiliar formats for activities, be equity-minded; it’s worthwhile to consider engaging the paid services of expert consultants in order to help you design these activities if you are not a member of the community served by your organization. For example, if your organization is primarily white-led and serves communities of color, learn from consultants of color about paternalism, white saviorism, and white-centering in order to reduce harm and open the way for new insights about leadership. As another example, it is a common phenomenon to center able-bodied thinking, male thinking, and gender-conforming thinking even among leaders who consider themselves allies. When an organization pivots quickly, any careful and equitable design of the former activities may not be carried over into the new activities. Enlisting the support of paid experts can help to reduce harm, advance the mission, and contribute to the most financially sustainable result.

Conclusion

Great leaders have an opportunity to create certainty in the face of the unknown, and to consider their accounting teams a vital source of planning wisdom in the process. Let go of oppressive systems, focus on workability, and work collaboratively to create the next chapter as your nonprofit advances the mission.

Jaime Campbell, CPA, MBA, CGMA, CTT, MCT is the co-owner of Tier One Services, LLC, an accounting firm serving organizations advancing social justice, including nonprofits and for-profit social enterprises. Mig Murphy Sistrom, CPA, is the owner of Mig Murphy Sistrom, CPA, PC, an accounting firm serving nonprofits with consulting and financial reporting.