As mission-driven organizations, nonprofits support, connect, educate, inspire, and revitalize our communities. North Carolina nonprofits also have a powerful impact on North Carolina's economy. (Download the report)

See the breakdown of total nonprofits, expenditures, employment, and annual wages by NC county and region.

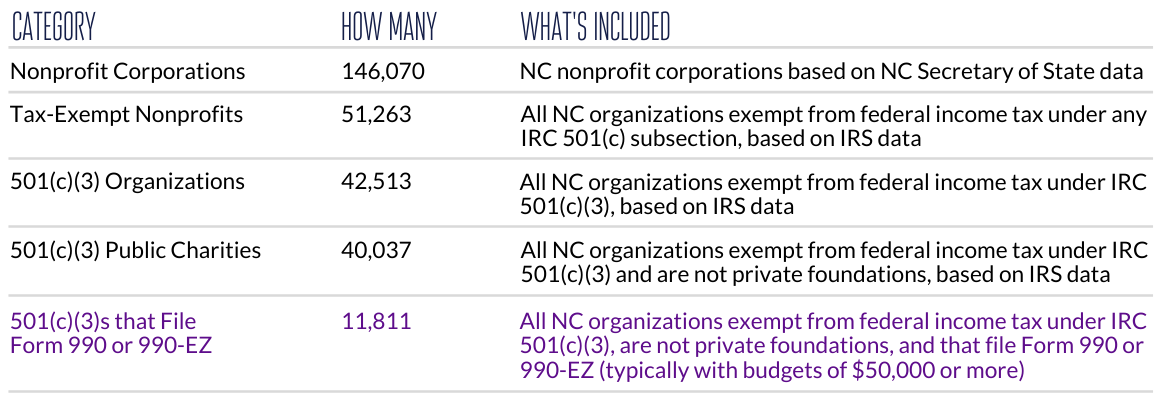

The definition of 'nonprofit corporation' is broad, and its distinct categories rely on information from IRS Form 990. Nonprofits that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code must operate for the public benefit, i.e. achieve specific charitable, religious, educational, scientific, or literary purposes.

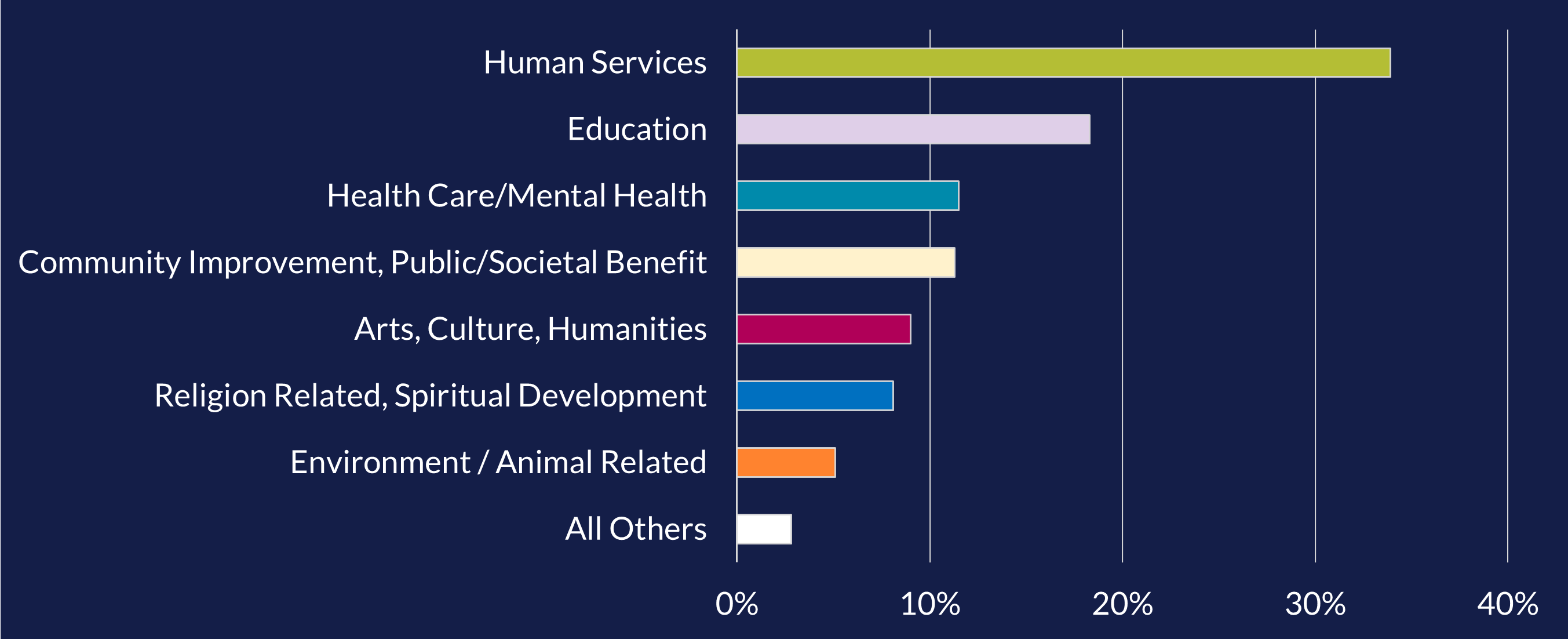

There are more than 40,000 charitable nonprofits operating in North Carolina. They are food banks, museums, senior centers, houses of worship, schools, theaters, research facilities, animal shelters, health clinics, housing assistance centers, transportation providers, and much more.

Most Nonprofits Are Very Small

North Carolina has 11,800 organizations that are 501(c)(3) nonprofits with annual revenues over $50,000. Hospitals and private colleges and universities comprise only about 1.5% of these nonprofits but account for just over half of nonprofits' $56 billion in spending.

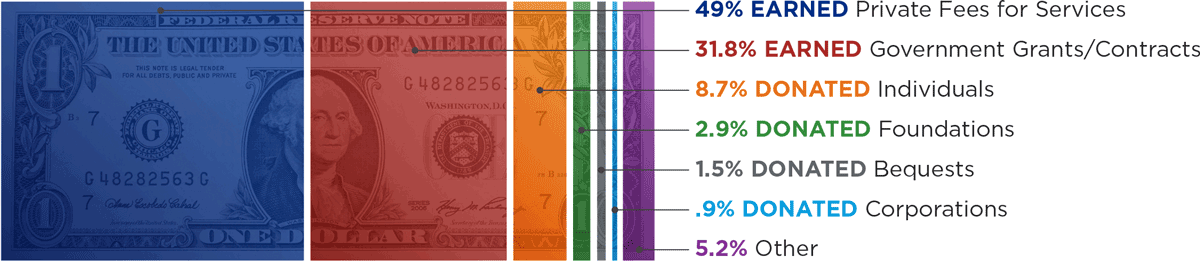

Nonprofits' Revenue Sources Are Varied

Nearly half of the sector's overall revenue comes from private fees for services like private schools, museums, health clinics, children's daycare, and senior care; one-third comes from government grants and contracts; only about 5% comes from individual and corporate contributions, even though these are the primary source of funding for many nonprofits.

However, Nonprofits Struggle with Skyrocketing Needs

72% of nonprofits saw more demand for their services during the pandemic as record numbers of people sought help at food banks, crisis assistance centers, homeless shelters, community health centers, domestic violence agencies, and consumer credit counseling services. (Nonprofit Finance Fund, 2022, https://nff.org/learn/survey)

And Nonprofits Continue to Experience Declines In Staffing, Giving, and Funding

Nonprofits have fewer staff to respond to these increasing needs. 72% of NC nonprofits are experiencing vacancies in at least 10% of their staff positions. Nonprofits had also lost about 40% of their volunteers in 2020, who have been slow to return.

40% of nonprofits reported revenue losses for 2020. While charitable giving initially increased at the onset of the pandemic, the pandemic giving incentives have expired, donor retention has declined, and overall giving has stagnated. (Independent Sector, 2022, independentsector.org)

The federal tax law changes that took effect in 2018 mean that fewer than 10% of North Carolina taxpayers now use the charitable deduction, down from over 30% in previous years.

The pandemic relief programs that helped nonprofits begin to recover last year - including the Paycheck Protection Program, Employee Retention Tax Credit, universal charitable deduction, and one-time federal and state grants - have all expired.

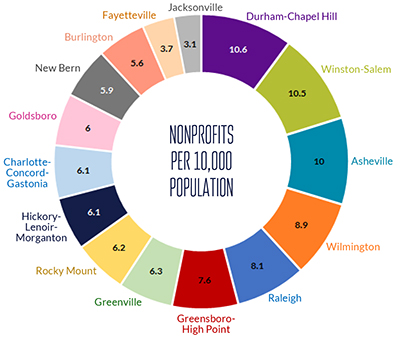

Nonprofits Are Not Evenly Distributed Across North Carolina

The Triangle (more than 3,000 nonprofits) and Charlotte (more than 2,500 nonprofits) have the most nonprofits of any region, while northeastern NC (about 400 nonprofits) has the fewest. The Durham-Chapel Hill, Winston-Salem, and Asheville areas all have at least 10 nonprofits for every 10,00 residents. Fayetteville and Jacksonville - the two NC cities with large military populations - are among the 10 cities in the country with the lowest number of nonprofits per capita. Total nonprofit employment and spending is greatest in the Triangle and Piedmont Triad regions.

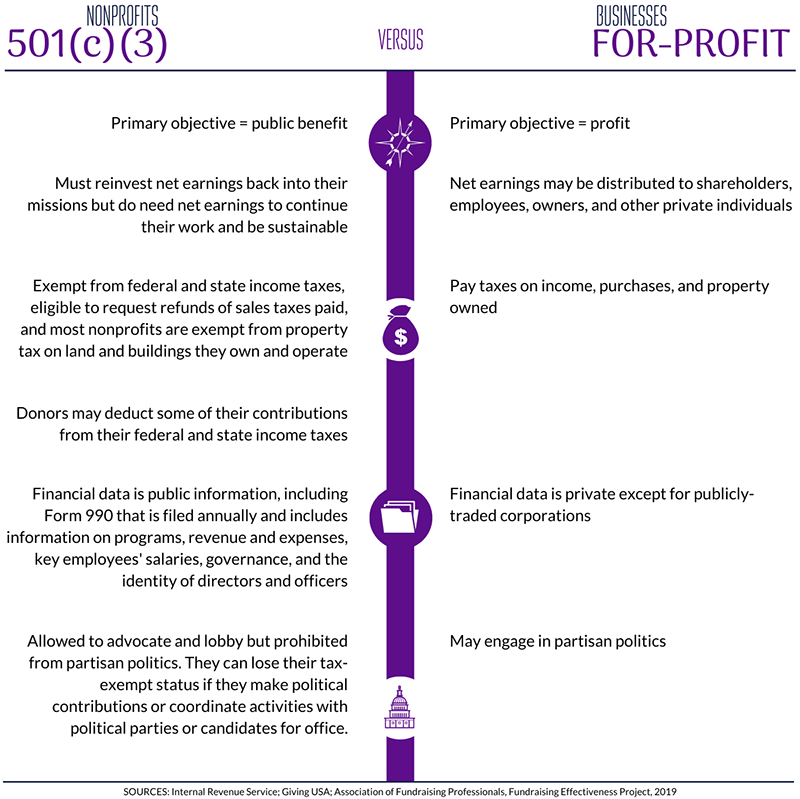

Nonprofits Versus For-Profits

501(c)(3) nonprofits and for-profit businesses are both private organizations but have fundamental differences that set them apart.

For more information, contact David Heinen, Vice President for Public Policy and Advocacy, 919-790-1555, ext.111 (office), 919-986-9224 (cell)

Updated September 2022